NFT and Wallet Security

Less than half of NFT owners feel their NFTs are secure [Survey]

Key Takeaways

- Two out of 3 respondents said they had panic-sold NFTs in the past.

- Nine out of 10 respondents had experienced an NFT scam.

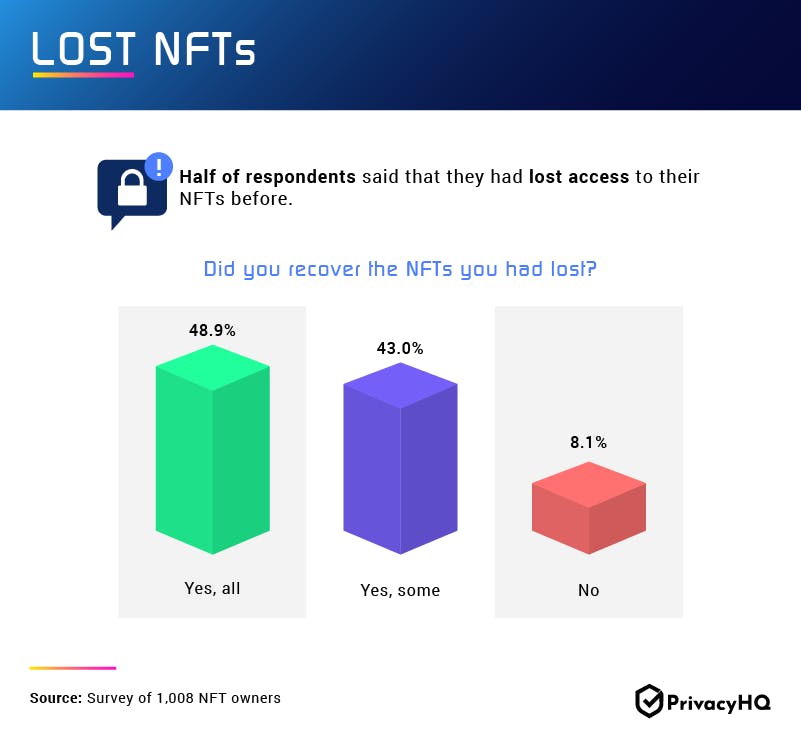

- Half of respondents had lost access to their NFTs at some point.

On-trend investors are pouring billions of dollars into NFTs—specifically $4 billion globally in the first half of 2021, then $18 billion in the second half. And while there are plenty of good reasons behind the hype—digital art selling for Van Gogh prices and the possibility for decentralization, for example—there’s also cause for caution.

Online sales of valuable digital art have led to the rise of NFT theft and scamming; and with even the average Joe investing quite a bit, there’s plenty at stake. With so much uncertainty, panic-selling and seller’s remorse are also risks. After speaking to 1,008 people in the U.S. who actively invest in and own NFTs, we’ve heard some of the worst horror stories. But we also uncovered ways people are keeping their digital assets safe and whether those that suffered losses were able to recoup them. Keep reading to find out what this new class of investors has to share.

Where Do People Keep Their NFTs?

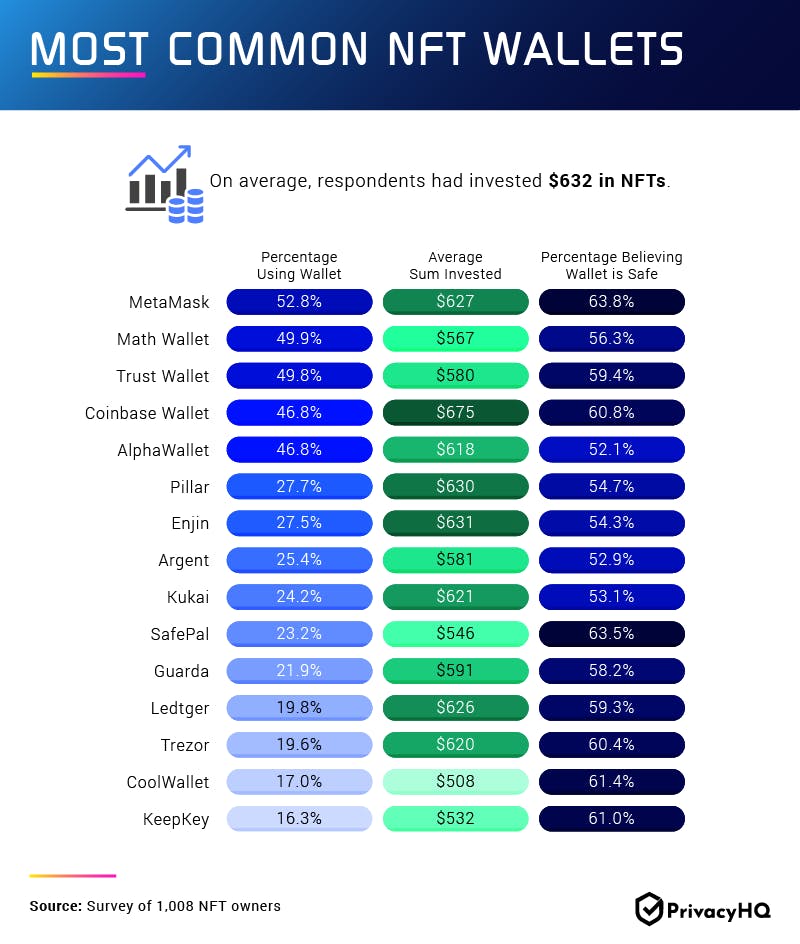

Since most NFT purchases and sales are transacted through Ethereum smart contracts, the only way they can be stored is in crypto wallets. The first section of our study asked respondents which NFT wallets they use, how much they’ve invested in them, and how secure they feel each option is.

MetaMask was the No. 1 choice for people wanting to store NFTs. Currently boasting 21 million users worldwide (and counting), it was the only wallet used by more than half of our respondents (52.8%). That said, Math Wallet, Trust Wallet, AlphaWallet, and Coinbase Wallet were not far behind, receiving an approval rating of between 49.9% and 46.8% each.

Coinbase Wallet, however, was the front-runner in terms of total investment. With $675 invested in the wallet on average, users flock to the app not just for NFTs, but for cryptocurrency in general. To put it in perspective, Coinbase (the parent of Coinbase Wallet) has more than 73 million users in comparison with MetaMask’s 21 million.

People were about equally as likely to rate Coinbase Wallet and MetaMask as secure, although MetaMask had the edge by 3 percentage points. A sense of security, however, was not a given with any of the wallets used. While MetaMask left users feeling more secure than any other wallet, only 63.8% of people felt their investments were safe there.

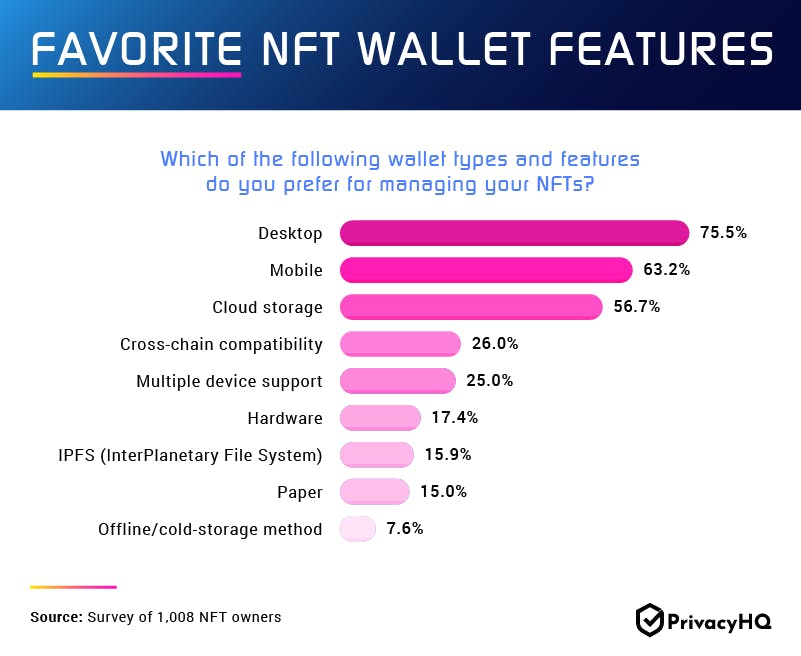

In order to manage their chosen NFTs, the majority of respondents gravitated toward desktop computers. Banking in general has opportunities to be less safe on a smartphone, simply because they travel, are easy to lose, and are more often connected to public Wi-Fi. That said, 63.2% used their mobile devices or perhaps a combination of mobile and desktop. According to many crypto experts, being able to access your NFTs on both a desktop and a mobile device—cross-device use—is a key feature to look for when choosing a wallet.

More than half also wanted some type of cloud storage option, which many believe keeps assets safer. When Chelsea art gallery owner Todd Kramer had more than $2 million in NFTs stolen from him, fellow investors chastised him for not using a storage option like this. Choosing the right wallet and storage method are going to be key components of NFT protection moving forward.

Security Concerns

With so much money on the line and so many people looking to gain access, we wanted to give respondents a chance to share how secure they feel their personal NFTs are right now and what safety measures they’re taking to protect them.

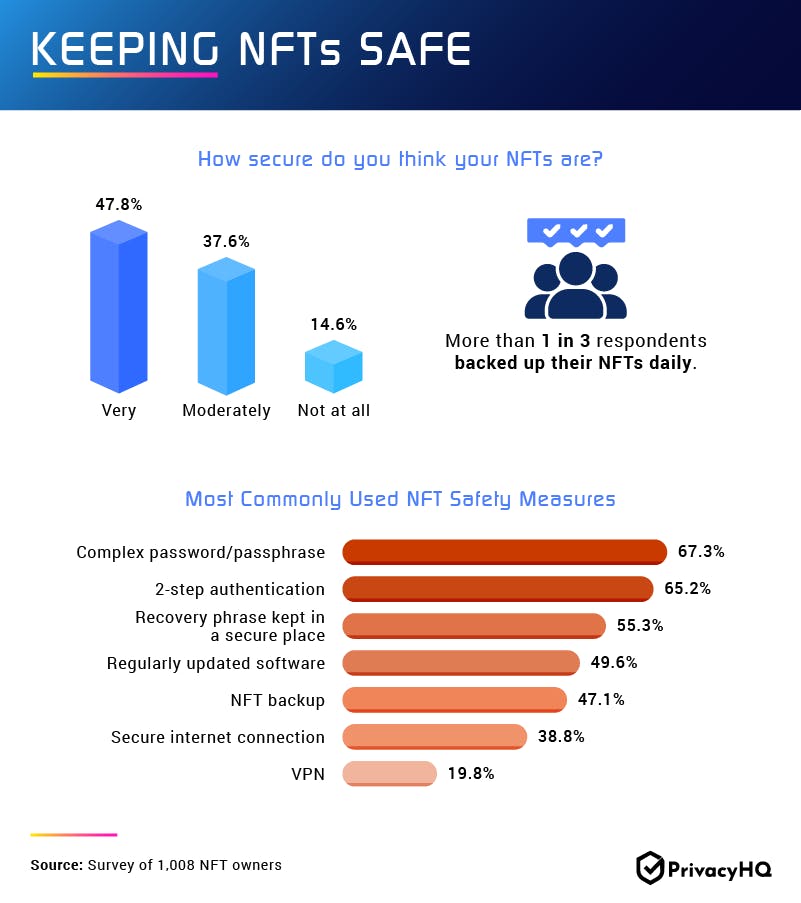

Fewer than half of respondents were able to say they felt very secure about the safety of their digital assets, while nearly 15% admitted they didn’t feel secure at all. And this was in spite of the fact that most people we spoke to were taking active steps to increase security.

Most often, people tried complex passwords and passphrases—a great first step. One of the most common methods hackers use to get into online accounts is guessing passwords, so it’s vital this digital key is as strong as possible. Two-factor authentication was also employed by 65.2%, while more than half said they kept their recovery information in a secure place. Evidently, even stringent cyber security practices like these are not enough for everyone to feel “very secure.”

Particular Hacks to Watch

Our respondents were next asked to share what is probably their worst NFT memory: the time(s) they got hacked. This section of our study looked at how many people have experienced a scam and what type of scam it was.

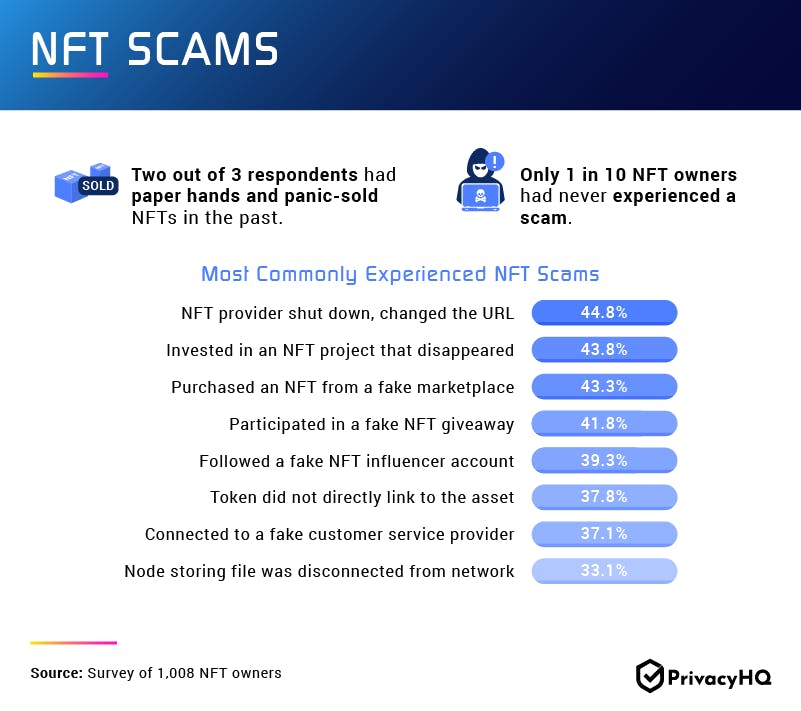

Getting your account hacked as an NFT owner is not at all uncommon: 16% of the people we spoke to had already been hacked. Just a small 10% were able to say they had never experienced a scam. Oftentimes, people also shot themselves in the foot and panic sold—in an example of what is known as having paper hands.

The most common scam people experienced, however, was the NFT provider shutting down altogether. With so many new providers popping up, software engineer Jonty Wareing took to Twitter to say “Right now NFTs are built on an absolute house of cards constructed by the people selling them.” Evidence does back this claim, since another 43.8% of respondents claimed they had purchased an NFT that completely disappeared. Another 43.3% fell victim to a fake marketplace scam. More than a third had even been connected with a fake customer service provider.

Recouping Losses

With such high price tags and the chance that those tags will only get higher, falling victim to NFT scams has quite a sting—not only for the loss of the original expense, but for the lost potential. The last section of our study focused on those who had lost NFTs and what they were able to recover.

As the data suggests, entering the NFT world, in all likelihood, involves possible exposure to scams. However, the good news is that there’s a high chance of getting your NFTs returned (at least partially) if you do fall victim. Over 90% of respondents were able to regain part, if not all, of what they had lost. Just a small 8.1% said they were unable to regain anything at all. The losses of this group totalled an average of $245 in lost NFTs.

NFT Safety and Security

Respondents ultimately revealed just how risky NFT investments can be—while most were actively engaged and heavily invested, they were also highly familiar with scams. Very few managed to get by without experiencing any security threats. Nevertheless, they persisted and often took advantage of important safety protocols to stay as secure as possible.

If you’re unsure of whether you’re taking sufficient safety measures online, whether for NFTs, banking, work, or beyond, there’s a very high chance you are putting your assets at risk. To stay safe and regret-free, lean on the help of the experts at Privacy HQ. Privacy HQ specializes in online safety, providing both detailed technical knowledge and all the latest privacy tips and tricks for you and your family. To see how Privacy HQ can help, head to our homepage today.

Methodology and Limitations

This study uses data from a survey of 1,008 NFT owners located in the U.S. Survey respondents were gathered through a bespoke online survey platform where they were presented with a series of questions, including attention-check and disqualification questions. 56.5% of respondents identified as men, while 43.5% identified as women. Respondents ranged in age from 18 to 81 years old with an average age of 37. 63.6% of respondents were millennials, 24% were Gen Xers, 3.2% were baby boomers, and 9.2% were Gen Zers. Participants incorrectly answering an attention-check question had their answers disqualified. This study has a 3% margin of error on a 95% confidence interval.

Please note that survey responses are self-reported and are subject to issues, such as exaggeration, recency bias, and telescoping.

Fair Use Statement

There’s safety in numbers! Get the word out about how to stay safe online by sharing this information. Just be sure your purposes are noncommercial and that you link back to this page.